Blog Layout

New Group Launched To Promote Opportunity Zones

New Group Launched To Promote Opportunity ZonesNon-Partisan Opportunity Funds Association Will Preserve, Promote, and Extend the Opportunity Zone Initiative

FOR IMMEDIATE RELEASE – Today, a bipartisan group of leading policy experts and investors launched the Opportunity Funds Association, a national non-partisan advocacy and public education organization with the mission of promoting Opportunity Zones. The organization will enable Opportunity Fund Managers and their parent companies to participate in public policy, develop best practices, and share the industry’s contributions to distressed communities throughout the country.

Focused on advocating for this critical policy and providing transparency on its impact, the Opportunity Funds Association will be led by Co-Founder & CEO Shay Hawkins. A former investment banker who spent a decade on Wall Street, Hawkins most recently served as Sen. Tim Scott (R-SC)’s lead tax policy advisor and was the driving force behind the Opportunity Zones provision making it into final passage of the 2017 Tax Cuts and Jobs Act. He also was the primary Capitol Hill liaison with Treasury during the critical phases of the Opportunity Zone rulemaking.

“This legislation has the potential to revitalize many communities that have been left behind,” said Hawkins. “But for that economic revitalization to become a reality, we must ensure effective and transparent implementation, and give voice to the millions who will benefit from these critical investments. Our values as an association are reflected in our mission statement: “OFA members connect capital to overlooked areas, improving lives, creating opportunities, and ensuring long-term economic growth in America’s most vulnerable communities.”

The mission of the Opportunity Funds Association enjoys bipartisan support from members throughout the country from inner cities to rural communities. “Shay Hawkins was an integral part of my staff and helped guide my landmark Opportunity Zones initiative,” said Sen. Tim Scott (R-SC), the driving force behind Opportunity Zones. “Because of his expertise and guidance, more than 31 million Americans may now have a chance to reach their fullest potential and attain the American Dream,” he added.

“The Opportunity Zones initiative has brought new urgency and attention to the challenges facing overlooked communities nationwide,” said

John Lettieri, President & CEO of the Economic Innovation Group, a public policy organization credited with developing the idea for opportunity zones. “That is why I am pleased to see the launch of the Opportunity Funds Association under the leadership of Shay Hawkins,” he added.

Among the steps the Opportunity Funds Association will take to ensure transparency will be the release of a website that allows qualified zone funds to show the public:

- What companies they are investing in;

- Where they are investing;

- How much they are investing;

- How many jobs these investments are creating;

“Virtua Partners understands Opportunity Zone investments have incredible potential to be transformation, but there needs to be metrics to measure the results. The industry reporting standards developed by the Opportunity Funds Association will provide transparency and accountability to both investors and communities. We are proud to be founding members of the organization” said CEO Quinn Palomino

About the Opportunity Funds Association:

The Opportunity Funds Association (OFA) is an advocacy, education, and communications organization established to enable Opportunity Fund managers and investors in Opportunity Funds to participate in public policy, share best practices, and communicate the industry’s contributions to distressed rural and urban communities across the country. OFA will help connect Opportunity Funds to investors and promote the successes of Opportunity Funds in the local communities and on Capitol Hill. Launched in May 2019, OFA is the only member-driven 501(c)(6) trade association exclusively for Qualified Opportunity Funds, their parent companies, and preferred service providers.

For media inquiries please call (203) 505-5737.

More Posts

17 Jun, 2020

Washington, DC— The Opportunity Funds Association (OFA) is proud to announce the addition of NES Financial, a JTC Company, as a new member and preferred service provider of Opportunity Fund Administration Services. A fintech company providing technology-enabled solutions for the efficient back- and middle-office administration of complex financial transactions, NES Financial is serving more than 75 clients with its purpose-built Opportunity Zone Fund Administration Solution. When NES Financial celebrated the signing of its 50th client at the end of 2019, OFA CEO Shay Hawkins remarked “with specialized opportunity funds and the importance of the long-term viability of the program, it’s great to see the industry embracing third party fund administrators such as NES Financial. Congratulations on signing your 50th client.” The NES Financial Opportunity Zone Fund Administration Solution is the only purpose-built OZ fund administration solution that addresses all the elements of the program and leverages technology to streamline fund administration to enhance the OZ fund experience and attractiveness for investors, facilitate compliance, and ultimately, help the Opportunity Zones program do the good it was meant to do. NES Financial is the North American division of JTC Group, a multi-jurisdictional provider of fund, corporate and private client services which administers more than $130 billion in assets and employs more than 900 people worldwide. The Opportunity Funds Association (OFA) is an advocacy, education, and communications organization established to enable Opportunity Fund managers and investors in Opportunity Funds to participate in public policy, share best practices, and communicate the industry’s contributions to distressed rural and urban communities across the country. For more information about the Opportunity Funds Association visit www.zonefunds.org.

17 Jun, 2020

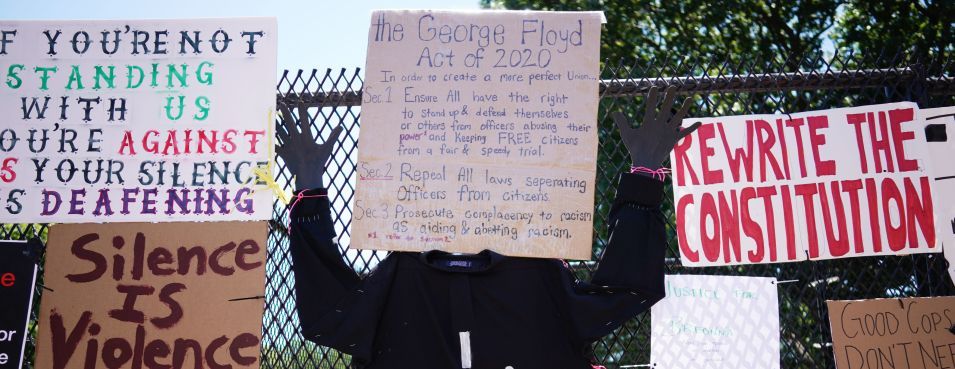

The environmental injustice that disadvantaged communities suffer affects the country’s overall health and economic bottom line, witnesses told House lawmakers Tuesday. “These injustices cost our country a huge amount of money” related to health impacts on people in communities that have historically been ignored, said Mustafa Santiago Ali. He spoke during a virtual Energy and Commerce subcommittee hearing with several Democrats and Republicans. “Everything from education to housing to a number of other components that stop communities from being able to move from surviving to thriving,” he said. Investing in more clean energy jobs and greener infrastructure is necessary to deal with future pandemics, but also to tackle the unfolding “climate emergency,” he said. Waiting to act is “going to end up costing us much more. So, it just makes sense to invest today,” said the former longtime official at the Environmental Protection Agency. Ali is the current vice president of environmental justice, climate, and community revitalization at the National Wildlife Federation. “Let’s make sure we are setting the table correctly,” said Ali, about incorporating environmental justice into the country’s recovery. ‘Central to Our Work’ Environmental justice concerns the environment, but it’s also about justice for communities of color when it comes to transportation, housing, public health and economics, Ali said. He said the EPA has an interagency working group that could be collaborating on the intersection of pollution and coronavirus with other government entities. Rep. Paul Tonko (D-N.Y.), chairman of the Environment and Climate Change Subcommittee, said the panel is “committed to making sure environmental justice is central to our work moving forward,” a point he emphasized earlier in the day during an interview with Politico. The subcommittee held a separate hearing on the issue last fall. The number of Covid-19 deaths and cases in communities of color, which have long been exposed to pollution, “tell us that what we do matters” in this space, Tonko said. “I think there is a lesson to all of us that there is an overlap in economic development policy, public health policy, and environmental policy,” he said. But lawmakers need to listen to frontline communities for the best solutions, said Jacqueline Patterson, senior director of the environmental and climate justice program for the NAACP. Patterson said policymakers should focus on what they can do to reduce energy costs for low-income communities, move away from subsidizing fossil fuel production, and prioritize pre-disaster mitigation. “We need to be making sure we have civil and human rights at the center of emergency management,” she said. The Heroes Act (H.R. 6800), which the House passed last month, contains language that would provide communities with environmental justice grants and ensure that low-income residents who can’t pay energy bills aren’t penalized by utility companies. Rep. Donald McEachin (D-Va.), who is on Energy and Commerce as well as the Committee on the Climate Crisis, said his environmental justice legislation would be incorporated into the report the climate panel releases this summer. ‘We Literally Can’t Breathe’ The well-attended virtual hearing coincided Tuesday with the funeral service for George Floyd, a black man whose death at the hands of Minneapolis police sparked nationwide protests. Particulate matter and air pollution exacerbate asthma and other respiratory disease, particularly in those with underlying chronic health conditions. People of color have been dying from Covid-19, the disease caused by the coronavirus, at much higher rates than the white population, despite being a smaller percentage of Americans overall. “Covid-19 continues to devastate black, brown, and indigenous communities both in infections and deaths,” said Ali, who blamed some of that on the Trump administration’s “rolling back” of environmental rules. “When we say, ‘I Can’t Breathe,’ we literally can’t breathe.” Panel Republicans agreed that environmental justice needs to be part of the equation but pushed back that the administration’s environmental policies contributed to the problem. Ranking Member Greg Walden (R-Ore.) pledged to “listen, learn and act” and noted there was “bipartisan” desire to explore how Covid-19 disproportionately impacted minority communities. But “we also need to reject overly burdensome regulations that might sound good in a soundbite but do little to help the environment while keeping workers from finding good-paying jobs,” he said. Opportunity Zones One area that could be ripe for bipartisanship involves expanding opportunity zones, with Republicans in particular touting the program during the hearing. The 2017 tax reform law created the zones, which give businesses such as in real estate incentives to invest in distressed and disadvantage communities across the country. A bipartisan Senate bill is pending that would require more data and transparency on how the program is working. Treasury Secretary Steven Mnuchin has estimated that approximately $100 billion will be invested in these communities over the next decade. That presents opportunities for everything from clean technology to more rural broadband, Shay Hawkins, president of the Opportunity Funds Association, told lawmakers. “They are not a panacea, but they are a very sharp tool in the community development toolbox,” said Hawkins, a former aide to Sen. Tim Scott (R-S.C.), who helped craft the legislative language related to Opportunity Zones. While Democrats and environmental advocates generally support the idea of Opportunity Zones, they also are wary that the incentives could offer more benefits to wealthy investors than the actual communities they are designed to help. “There’s been a lot of talk about Opportunity Zones,” said Rep. Nanette Barragan (D-Calif.). “I support Opportunity Zones to help create jobs, but that’s not going to help our black and brown communities that have to live in these communities right next to air pollution.” The Internal Revenue Service in June issued guidance extending rules related to investments in eligible Opportunity Zones because of the coronavirus pandemic. To contact the reporter on this story: Kellie Lunney in Washington at klunney@bloombergindustry.com To contact the editor responsible for this story: Gregory Henderson at ghenderson@bloombergindustry.com

By Surya Gunasekara

•

09 Mar, 2020

Washington, DC— The Opportunity Funds Association (OFA) announces the addition of Sean Lyons as a new member of its Board of Directors. Sean Lyons is a founding partner of Jackson Dearborn Partners, a leading vertically integrated real estate development firm headquartered in downtown Chicago. Mr. Lyons’ primary areas of focus include fundraising, investor relations, and marketing. Sean has over 20 years of experience including the last 16 as a real estate broker and principal participating in well over $1 billion in real estate transactions. Following a successful career in sales, He started his real estate career with Marcus & Millichap in 2003, eventually founding his own brokerage company, Triad Real Estate Partners, in 2010 with partners Shaun Buss and Ryan Tobias. Moving to the principal side, He went on to found JDP where he utilizes creative marketing and an extensive network to build a portfolio of real estate and relationships. “We were thrilled to hear that OFA member firm Jackson Dearborn Partners designated Sean for their seat on our Board. As the Opportunity Zones landscape develops, its encouraging to see leaders emerge who can articulate both the potential challenges and enormous potential of the new policy,” said Shay Hawkins, President of the Opportunity Funds Association. “As a Forbes magazine contributor and seasoned developer, Sean is positioned lead our members in maximizing the amount of capital going into distressed communities and maximizing the impact of that capital on existing residents.” Mr. Lyons is originally from Philadelphia and is a graduate of Boston College. He lives in Wilmette, IL with his wife Gretchen and their four children. The Opportunity Funds Association (OFA) is an advocacy, education, and communications organization established to enable Opportunity Fund managers and investors in Opportunity Funds to participate in public policy, share best practices, and communicate the industry’s contributions to distressed rural and urban communities across the country. For more information about the Opportunity Funds Association visit www.zonefunds.org .